Impact investment reporting for a private equity firm.

Design and production of an inaugural impact report for an alternatives investment firm focused on measurable outcomes.

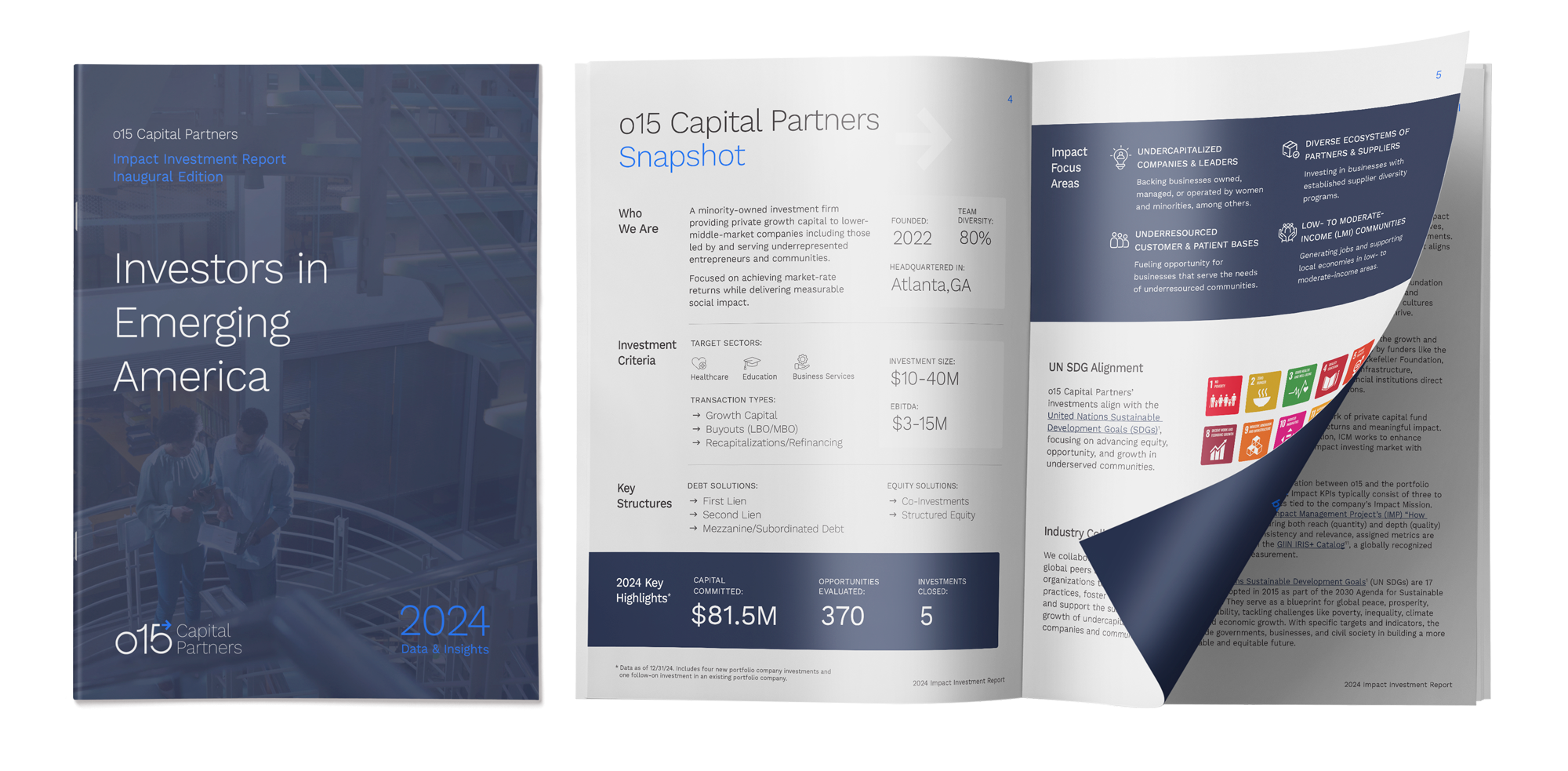

Based in Atlanta, o15 Capital Partners is an alternatives investment firm that provides growth capital to undercapitalized lower middle market businesses and communities in the Healthcare, Education, and Business Services industries.

CHALLENGE

As a newer firm with a clear impact thesis, o15 Capital Partners sought to present its impact approach through a refined, purpose-built inaugural impact report.

SOLUTION

o15 Capital Partners partnered with Inform Solutions to develop its inaugural Impact Investment Report to articulate the firm’s impact thesis, investment approach, and early outcomes, while establishing a consistent structure to support future reporting. Working closely with the o15 team, Inform Solutions shaped a cohesive narrative that integrated firm strategy, portfolio insights, impact measurement, and industry engagement into a polished publication aligned with investor expectations and impact-focused best practices.

RESULTS

The inaugural Impact Investment Report provided o15 with a clear and credible platform to communicate its mission, strategy, and early impact. The publication supported investor conversations and positioned the firm clearly within the impact investing ecosystem.

HIGHLIGHTS

Inaugural impact investment report

Clear articulation of impact thesis and investment approach

Integrated narrative across strategy, portfolio insights, and impact measurement

Investor-ready publication aligned with impact best practices

Repeatable structure to support future reporting